When it comes to growing your wealth and securing your financial future, understanding the right investment strategies is crucial. In the diverse landscape of investing, choosing the best approach can be overwhelming. Whether you’re new to investing or looking to refine your strategy, knowing the top investment strategies in the United States can provide valuable insights.

In this blog post, we’ll explore the top 10 investment strategies, each offering unique characteristics and benefits. From the simplicity of index fund investing to the active management of tactical asset allocation, we’ll break down what makes each strategy distinct and how they can align with your financial goals. Dive in to discover which investment approach might be the perfect fit for you!

Table of Contents

Index Fund Investing

Hey there! Let’s kick things off with one of the most popular and straightforward investment strategies: index fund investing. If you’re new to investing or just looking for a way to get broad market exposure without breaking the bank, index funds might be your go-to option.

So, what’s an index fund? Think of it like this: an index fund is a type of mutual fund or exchange-traded fund (ETF) that aims to replicate the performance of a specific market index, like the S&P 500 or the Dow Jones Industrial Average. Instead of trying to pick individual stocks, an index fund buys a broad mix of stocks that are included in that index. It’s kind of like buying a little piece of the entire market at once.

What makes index funds unique? For starters, they offer something called diversification, which is just a fancy way of saying you’re spreading your investment across many different stocks. This helps to reduce the risk because even if one stock doesn’t perform well, the others might pick up the slack. Plus, index funds usually have lower fees compared to actively managed funds because they don’t require a team of analysts to pick stocks—they just follow the index.

Another great thing about index funds is their simplicity. You don’t need to worry about constantly monitoring the market or making decisions about which stocks to buy or sell. Just set up your investment, and let it ride!

Of course, there are a few things to keep in mind. While index funds are designed to mirror the performance of the market, they also mean you’ll experience the market’s ups and downs. If the market takes a hit, so will your investment. But on the flip side, over the long term, markets tend to grow, which is why many investors like index funds for their potential to offer steady, long-term returns.

If you’re looking for a low-cost, hassle-free way to invest that gives you broad market exposure, index funds are definitely worth considering. They’re a great option for both beginners and seasoned investors who want to keep things simple while still getting a good bang for their buck.

Dividend Investing

Alright, let’s dive into dividend investing. If you’re looking for an investment strategy that combines potential income with the chance for capital appreciation, dividend investing could be right up your alley.

So, what’s dividend investing all about? It’s pretty straightforward: this strategy focuses on investing in stocks that pay dividends. Dividends are essentially a portion of a company’s earnings distributed to shareholders, usually on a quarterly basis. Think of them as a reward for holding onto the stock.

What makes dividend investing stand out? For starters, it provides a steady stream of income. If you own dividend-paying stocks, you’ll receive regular payments, which can be a great way to boost your cash flow. This can be especially appealing if you’re retired or looking for a way to supplement your income without having to sell your investments.

Another cool feature of dividend investing is the power of compounding. You can reinvest the dividends you receive to buy more shares of the stock, which can help grow your investment over time. It’s like getting paid to buy more of what you already own.

But, it’s not all sunshine and rainbows. There are a few things to be aware of. First off, not all companies pay dividends. Dividend-paying stocks are usually established companies with a stable financial position. So, if you’re looking at high-growth stocks or startups, they might not offer dividends as they might reinvest their profits to fuel growth.

Also, dividend stocks can sometimes be more sensitive to economic downturns. If a company faces financial trouble, it might cut or suspend its dividend payments. So, while dividends can be a great source of income, it’s important to choose companies with a strong track record of maintaining their dividends.

In a nutshell, dividend investing is all about seeking out stocks that pay regular dividends to generate income and potentially benefit from capital appreciation. It’s a strategy that can provide a reliable cash flow and the opportunity for growth, making it an attractive option for many investors.

Value Investing

Now let’s talk about value investing—a strategy that’s all about finding those hidden gems in the stock market. If you’re someone who enjoys diving into financial statements and doing a bit of detective work, value investing might be right up your alley.

So, what’s value investing? At its core, this strategy involves looking for stocks that are undervalued relative to their intrinsic value. Essentially, you’re searching for companies that are trading for less than what they’re truly worth. This often means analyzing financial metrics, such as earnings, revenue, and book value, to figure out whether a stock is a bargain or just a dud.

What makes value investing unique? One of the key aspects is the emphasis on buying low and holding until the market recognizes the stock’s true value. Value investors believe that the market can be irrational and that stocks can sometimes be priced below their true worth. By finding these undervalued stocks, you’re aiming to purchase them at a discount and benefit when their value eventually increases.

Another unique characteristic of value investing is its focus on fundamentals. Instead of chasing the latest hot stock or trend, value investors dig into a company’s financial health, competitive position, and growth prospects. They look for companies with strong fundamentals that might be temporarily overlooked or undervalued by the market.

But, as with any strategy, there are a few caveats. Value investing often requires patience. The market might take time to recognize the true value of a stock, and in the meantime, you could experience periods of underperformance. Plus, not every stock that appears undervalued is necessarily a good investment—some may be cheap for a reason.

Value investing is all about finding stocks that are priced below their intrinsic value based on solid fundamental analysis. It’s a strategy that can lead to significant long-term gains, especially if you’re willing to hold onto your investments and weather market fluctuations. If you enjoy digging into financials and uncovering bargains, value investing could be a rewarding approach for you.

Growth Investing

Next up, let’s explore growth investing—an exciting strategy that’s all about chasing potential and aiming for significant returns. If you’re energized by the idea of investing in companies that are on a fast track to success, growth investing might be your perfect match.

So, what’s growth investing? In a nutshell, it involves putting your money into companies that are expected to grow at an above-average rate compared to others in the market. These companies often reinvest their profits back into the business to fuel expansion, innovate, and capture more market share. As a growth investor, you’re betting that these companies will experience rapid revenue and earnings growth, leading to substantial increases in their stock prices.

What makes growth investing unique? The primary focus is on potential rather than current value. Growth investors look for businesses with strong prospects for future growth, even if their current financials don’t seem particularly impressive. This could include tech startups with cutting-edge products, companies in emerging industries, or firms with innovative business models.

Another distinctive feature is the tolerance for higher volatility. Growth stocks often experience more price swings compared to more established, stable companies. This is because their future performance is often tied to broader economic trends or the success of new products and technologies. So, if you’re comfortable with a bit of roller-coaster action in exchange for potentially high rewards, growth investing could be appealing.

However, growth investing does come with its own set of challenges. The high growth potential often means that these stocks come with higher valuations, which can be risky if the anticipated growth doesn’t materialize. Additionally, growth stocks may not pay dividends, as their profits are typically reinvested into the business.

Growth investing is all about targeting companies with strong potential for future growth, accepting higher volatility in pursuit of significant capital appreciation. If you’re excited by innovation and willing to embrace a bit of risk, growth investing could be a thrilling and rewarding strategy for you.

Buy and Hold

Let’s dive into the “buy and hold” strategy, a classic approach that’s all about patience and long-term thinking. If you’re the type of investor who believes in the power of time and isn’t easily swayed by market ups and downs, this strategy might be right up your alley.

So, what exactly is buy and hold? The concept is pretty simple: you buy stocks (or other investments) and hold onto them for an extended period, regardless of market fluctuations. Instead of trying to time the market or make frequent trades based on short-term movements, you invest with the intention of holding onto your assets for years, if not decades.

What makes buy and hold unique? One of the key aspects is the emphasis on long-term growth. By sticking with your investments over a long period, you give them the opportunity to grow and compound, benefiting from overall market trends and company performance. Historically, markets tend to rise over the long term, and this strategy capitalizes on that trend.

Another unique characteristic is its simplicity and low maintenance. With buy and hold, you don’t need to constantly monitor the market or make decisions about buying and selling. Once you’ve made your investment choices, you can sit back and let them grow. This approach also tends to incur lower transaction costs, as you’re making fewer trades.

However, the buy and hold strategy does require a strong stomach and a long-term perspective. Market downturns and volatility can be unsettling, but with this strategy, the idea is to ride out these periods and stay focused on the long-term gains. It also requires some confidence in your initial investment choices, as you’re committing to holding them through market ups and downs.

Buy and hold is all about committing to your investments for the long term, allowing them to benefit from market growth and compounding returns. It’s a straightforward, low-maintenance strategy that relies on patience and confidence in your investment choices. If you’re ready to take a long-term view and weather market fluctuations, buy and hold could be a solid approach for you.

Dollar-Cost Averaging

Let’s take a look at dollar-cost averaging, a strategy that’s all about consistency and reducing investment risk over time. If you’re looking for a disciplined approach that takes the guesswork out of market timing, this could be the strategy for you.

So, what exactly is dollar-cost averaging? It’s a method where you invest a fixed amount of money into a particular investment at regular intervals, regardless of the market’s performance. For example, you might invest $200 in a mutual fund every month. This means that you buy more shares when prices are low and fewer shares when prices are high.

What makes dollar-cost averaging unique? One of the standout features is its ability to reduce the impact of market volatility. By spreading out your investments over time, you smooth out the highs and lows of the market, which can help minimize the risk of investing a large amount of money at the wrong time. Essentially, you’re buying into the market gradually rather than making a lump sum investment all at once.

Another unique aspect is that it encourages a disciplined investment approach. Since you’re investing on a set schedule, you’re less likely to be swayed by market fluctuations or emotional decisions. This regular investment habit can also help you build wealth steadily over time.

However, it’s important to note that dollar-cost averaging doesn’t guarantee profits or protect against losses in a declining market. If the market trends downward consistently, your investments will still lose value, though you might have bought in at lower prices compared to a single lump sum investment.

Dollar-cost averaging is all about investing a fixed amount regularly to reduce the impact of market volatility and encourage disciplined investing. It’s a strategy that helps smooth out the investment process and can be a great way to build wealth over time without getting caught up in the ups and downs of the market. If you’re looking for a consistent and less stressful way to invest, dollar-cost averaging might be a good fit for you.

Asset Allocation

Now, let’s explore asset allocation—a strategy that’s all about balancing your investments to match your goals and risk tolerance. If you’re looking to create a diversified portfolio that can weather different market conditions, asset allocation is key.

So, what’s asset allocation? At its core, asset allocation involves spreading your investments across various asset classes, such as stocks, bonds, real estate, and cash. The idea is to create a mix of investments that aligns with your financial goals, time horizon, and risk tolerance. By diversifying your portfolio, you aim to balance potential risks and returns.

What makes asset allocation unique? The main feature is its focus on diversification. Instead of putting all your eggs in one basket, you spread your investments across different types of assets. This can help reduce the impact of any single asset class’s poor performance on your overall portfolio. For instance, if stocks are underperforming, bonds or real estate might still perform well, helping to offset losses.

Another unique aspect is its flexibility. Asset allocation isn’t a one-size-fits-all approach. You can tailor your mix of assets based on your personal financial situation, investment goals, and risk appetite. As you get closer to your investment goals, such as retirement, you can adjust your asset allocation to be more conservative, focusing more on lower-risk investments.

However, asset allocation requires ongoing management. It’s not a set-it-and-forget-it strategy. You’ll need to periodically review and adjust your portfolio to ensure it continues to align with your goals and the changing market environment. This might involve rebalancing, which means adjusting the proportions of each asset class in your portfolio.

Asset allocation is about creating a diversified investment mix that balances risk and return based on your individual goals and risk tolerance. It’s a dynamic strategy that helps protect against market volatility and can be tailored to fit your specific financial needs. If you’re looking for a way to manage risk while aiming for long-term growth, asset allocation could be a smart approach for you.

Real Estate Investing

Next up, let’s dive into real estate investing—a strategy that’s all about leveraging property to build wealth and generate income. If you’re interested in tangible assets and the potential for steady cash flow, real estate investing could be an appealing option.

So, what is real estate investing? At its core, it involves buying, owning, and managing property to earn income or make a profit. This can include residential properties like single-family homes or apartment buildings, commercial properties such as office spaces and retail centers, or even real estate investment trusts (REITs) that allow you to invest in real estate without directly owning physical properties.

What makes real estate investing unique? One of the standout features is the ability to generate rental income. If you invest in rental properties, you can earn a steady stream of cash flow from tenants paying rent. This can provide a reliable income source, which is particularly appealing for retirees or those seeking passive income.

Another unique characteristic is the potential for property appreciation. Over time, real estate values can increase, allowing you to sell your property for a profit. Plus, owning property can offer additional benefits like tax advantages, including deductions for mortgage interest and property taxes.

However, real estate investing comes with its own set of challenges. It often requires a significant initial investment, including the cost of purchasing the property, maintenance, and management expenses. Managing rental properties can also be time-consuming and may involve dealing with tenants and property maintenance issues.

Additionally, real estate markets can be cyclical, and property values may fluctuate based on economic conditions. This means that while you could see significant appreciation, there’s also a risk of property values declining.

Real estate investing involves purchasing property to generate income or capital gains. It offers the potential for steady cash flow and appreciation but also comes with challenges like substantial initial investment and ongoing management responsibilities. If you’re interested in tangible assets and have the resources to manage them, real estate investing could be a rewarding way to build wealth and diversify your investment portfolio.

Short Selling

Let’s dive into short selling—a strategy that’s a bit more advanced and involves betting against a stock. If you’re comfortable with higher risk and have a knack for predicting market downturns, short selling might be a strategy to explore.

So, what is short selling? Essentially, it’s a technique used to profit from a decline in a stock’s price. Here’s how it works: you borrow shares of a stock from a broker and sell them at the current market price. If the stock price drops as you anticipated, you can then buy back the shares at the lower price, return them to the broker, and pocket the difference as profit.

What makes short selling unique? The key feature is that it allows you to profit from falling stock prices. While most investing strategies are focused on capitalizing on rising prices, short selling turns this idea on its head by targeting potential declines. This can be particularly useful in bear markets or when you believe a stock is overvalued and due for a correction.

Another unique aspect is the need for precise timing. Since you’re betting against the stock, you need to be accurate about when to enter and exit the trade. If the stock price goes up instead of down, you could face significant losses, as there’s theoretically no limit to how high a stock’s price can go.

However, short selling comes with several risks. The most notable is the potential for unlimited losses. Unlike traditional investing, where your losses are capped at the amount you invested, short selling carries the risk of the stock price rising indefinitely, leading to potentially enormous losses. Additionally, short selling can be more complex and require a good understanding of the market and its mechanisms.

Short selling is a strategy that involves borrowing and selling stocks with the intention of buying them back at a lower price to profit from a decline. It’s a high-risk, high-reward approach that requires careful timing and market insight. If you’re willing to take on greater risk and can accurately predict market movements, short selling might offer unique opportunities to profit from falling stock prices.

Tactical Asset Allocation

Finally, let’s explore tactical asset allocation—a strategy that combines strategic planning with the flexibility to adapt to changing market conditions. If you’re someone who likes to stay on top of market trends and adjust your investment mix accordingly, tactical asset allocation could be a great fit for you.

So, what is tactical asset allocation? It’s a method of actively adjusting your asset allocation based on short-term market conditions or economic forecasts. Unlike traditional asset allocation, which maintains a set mix of asset classes based on long-term goals and risk tolerance, tactical asset allocation involves making periodic changes to take advantage of perceived opportunities or to protect against potential risks.

What makes tactical asset allocation unique? One of the standout features is its flexibility. By adjusting your portfolio based on current market trends or economic indicators, you can potentially enhance returns and manage risk more effectively. For instance, if you believe that stocks are overvalued and bonds are likely to perform better, you might shift a portion of your investments from equities to fixed income.

Another unique characteristic is the focus on short-term opportunities. Tactical asset allocation allows you to respond to market movements or economic developments that might impact asset performance. This could involve shifting allocations between equities, bonds, real estate, and other asset classes to capitalize on emerging trends or avoid potential downturns.

However, tactical asset allocation also comes with its challenges. It requires ongoing market research and analysis, as well as the ability to make timely decisions. This can be demanding and may involve higher transaction costs due to frequent rebalancing. Additionally, there’s a risk of underperforming if market predictions are off or if the timing of adjustments isn’t optimal.

In summary, tactical asset allocation is a dynamic approach that involves actively adjusting your asset mix based on current market conditions and forecasts. It offers the potential to enhance returns and manage risk by responding to short-term opportunities and challenges. If you’re comfortable with active management and staying informed about market trends, tactical asset allocation could be a strategic way to optimize your investment portfolio.

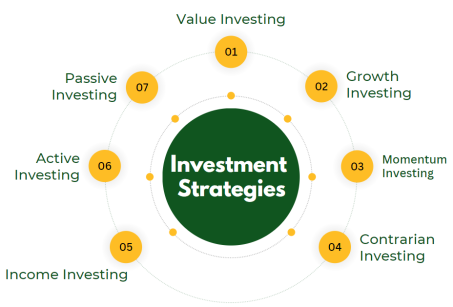

As we wrap up our exploration of the top 10 investment strategies in the United States, it’s clear that there’s no one-size-fits-all approach to investing. Each strategy offers its own unique advantages and challenges, and the best choice for you will depend on your personal financial goals, risk tolerance, and investment style.

From the broad, low-cost exposure of index fund investing to the potential for significant returns with growth investing, each strategy provides different ways to navigate the markets. Dividend investing can offer a steady income stream, while value investing focuses on uncovering undervalued opportunities. The buy and hold approach emphasizes patience and long-term growth, whereas dollar-cost averaging provides a disciplined, less risky investment method.

Asset allocation is all about balancing your portfolio to match your goals and risk tolerance, while real estate investing introduces the potential for rental income and property appreciation. Short selling can capitalize on declining stock prices, though it involves higher risk, and tactical asset allocation allows for active adjustments based on market conditions.

Ultimately, the key to successful investing is understanding each strategy and how it aligns with your individual needs. Whether you prefer the hands-off approach of index funds or the active management of tactical asset allocation, it’s important to choose strategies that fit your financial situation and investment philosophy.

Remember, effective investing isn’t just about picking the right strategy; it’s also about staying informed, being patient, and making decisions that align with your long-term goals. By considering the unique characteristics of each strategy and how they fit into your overall investment plan, you can build a portfolio that helps you achieve your financial objectives while navigating the complexities of the market.

Thanks for joining us on this investment journey. Here’s to making informed choices and building a robust investment strategy tailored just for you! [FinansieraTrading.com]