Why Delayed Retirement Could Be a Hidden Goldmine for Your Future is a question worth exploring in today’s fast-changing financial landscape. With life expectancy increasing and retirement savings often falling short of expectations, postponing retirement is no longer just a fallback plan—it’s a powerful strategy for achieving financial security and personal growth. By working a few extra years, you can unlock a range of benefits, from significantly larger Social Security payments to more robust retirement savings and even improved mental and physical well-being.

Many people overlook the hidden opportunities that come with delaying retirement. For instance, did you know that for every year you delay claiming Social Security beyond your full retirement age, your benefits increase by about 8%? This simple decision could translate into thousands of additional dollars annually, providing a safety net for your golden years. Moreover, staying active in the workforce can foster a sense of purpose, keep your mind sharp, and even enhance your overall happiness.

This article uncovers why Delayed Retirement Could Be a Hidden Goldmine for Your Future isn’t just a topic for financial experts—it’s a game-changing option for anyone looking to secure a brighter, more fulfilling future. Let’s dive into the surprising advantages and strategies that make this decision a hidden treasure for your retirement planning.

Table of Contents

Why Delaying Retirement Makes Financial Sense

The financial benefits of delaying retirement:

- Boost in Social Security Benefits:

Delaying Social Security claims beyond the full retirement age (FRA) can lead to significant financial rewards. For every year you delay claiming benefits past your FRA until age 70, your monthly benefits increase by approximately 8% annually. This increase, known as delayed retirement credits, is a powerful incentive for those who can afford to wait.- Example Calculation:

- Purpose:

- To visually demonstrate the progressive increase in benefits with each year of delay, making it easier for readers to grasp the financial advantages of waiting

- Longer Investment Horizon: The Power of Extra Years

- Delaying retirement extends your investment horizon, allowing your savings and investments more time to grow. With additional years to contribute to retirement accounts and benefit from compound interest, you can significantly enhance your financial security in later years.

- How It Works:

- Extended Contributions:

By continuing to work and contribute to accounts like 401(k)s or IRAs, you not only add more principal but also give your money more time to compound. For example: - Contributing $10,000 annually for 5 extra years with a 7% annual return adds approximately $58,000 in growth by the end of the period.

- Extended Contributions:

- Delaying Withdrawals:

A delayed retirement also means you postpone tapping into your savings. This allows your investments to continue growing while reducing the total number of withdrawal years.- Example: If a $500,000 portfolio grows at 6% annually, delaying withdrawals for 5 years increases the portfolio to $669,000.

- Key Benefits:

- Higher account balances at the start of retirement.

- Reduced risk of depleting your funds too early.

- Opportunity to weather short-term market fluctuations without needing immediate withdrawals.

- Employer Benefits and Pension Enhancements:

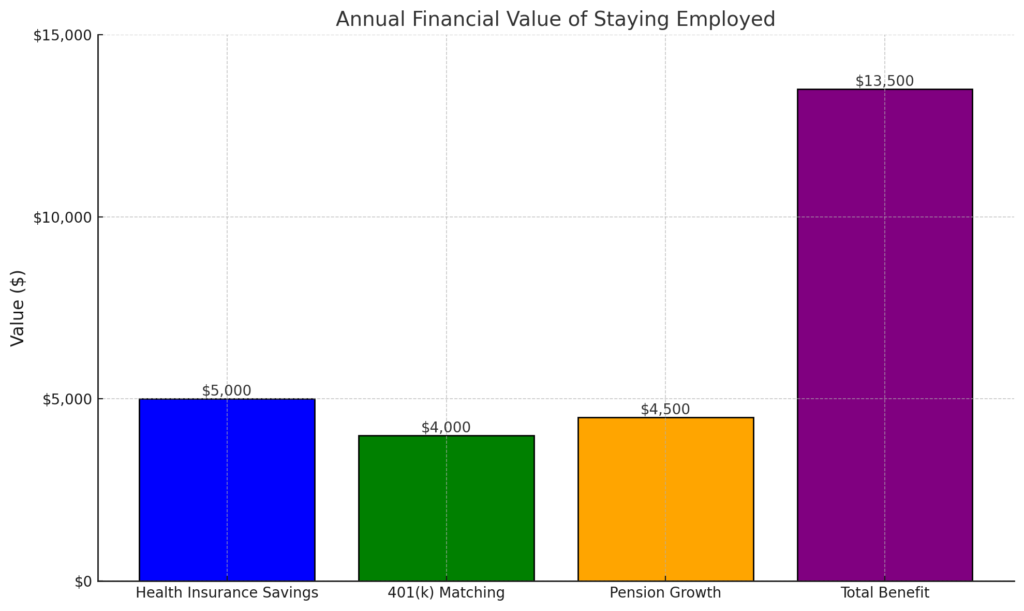

Continuing to work past traditional retirement age doesn’t just increase your income—it can also provide access to valuable employer-sponsored benefits and enhance your pension. These benefits can reduce your financial burden in retirement and allow your investments to grow uninterrupted.- Key Benefits of Staying Employed:

- Access to Health Insurance:

- Many employers offer subsidized health insurance plans for active employees, which are often more affordable than private insurance or Medicare supplements.

- Example: Employees aged 60–65 can save thousands annually by staying on an employer-provided plan.

- 401(k) Matching Contributions:

- Employers often match a percentage of your 401(k) contributions, providing an immediate return on your savings.

- Example: If your employer matches up to 5% of your salary and you earn $80,000 annually, that’s an extra $4,000 each year added to your retirement fund.

- Pension Enhancements:

- Many pension plans reward longer service by increasing the payout rate. Delaying retirement could mean a higher monthly pension for life.

- Example: A pension plan may offer 1.5% of your salary per year of service. Delaying retirement by 5 years with a $60,000 salary adds $4,500 annually to your pension ($60,000 × 1.5% × 5).

- Deferred Benefits Growth:

- Some employers provide incentives for staying longer, such as increased vacation accruals or retention bonuses.

- The Financial Impact:

- By remaining in the workforce:

- You reduce the need to dip into your savings for healthcare or living expenses.

- You enhance your retirement savings and secure better long-term income streams.

- By remaining in the workforce:

Health Benefits of Staying in the Workforce

- Improved Mental Health:

Explain how staying engaged in meaningful work reduces the risk of cognitive decline.- Research data: “Studies show a 30% lower risk of dementia among those who remain professionally active past 65.”

- Physical Benefits of Daily Activity:

Working longer often keeps individuals more physically active and socially engaged, which is linked to better health outcomes. - Purpose and Fulfillment:

Highlight how working gives a sense of purpose, which has been linked to increased longevity.The Power of Purpose: Insights from the Blue Zones Study- The Blue Zones Study, which examined regions of the world where people live the longest and healthiest lives, found a remarkable connection between a strong sense of purpose and increased life expectancy. According to the study, individuals with a clearly defined sense of purpose can add up to seven additional years to their lives. This sense of purpose, often referred to as “ikigai” in Japan, is not only a psychological motivator but also a factor that influences physical and mental health.

- How Purpose Extends Life:

- Mental Resilience:

Purpose provides a reason to engage with life, fostering optimism and resilience even in challenging times. - Physical Health:

Those with a strong sense of purpose are more likely to stay active, maintain healthier lifestyles, and manage stress effectively. - Social Connection:

Purpose often involves contributing to a community or loved ones, which strengthens social bonds—a key factor in longevity.

- Mental Resilience:

- How Purpose Extends Life:

- This insight emphasizes the holistic benefits of staying active, whether through work, volunteering, or personal pursuits, particularly for individuals who delay retirement. It’s not just about financial gains but also about cultivating a fulfilling and extended life.

- The Blue Zones Study, which examined regions of the world where people live the longest and healthiest lives, found a remarkable connection between a strong sense of purpose and increased life expectancy. According to the study, individuals with a clearly defined sense of purpose can add up to seven additional years to their lives. This sense of purpose, often referred to as “ikigai” in Japan, is not only a psychological motivator but also a factor that influences physical and mental health.

Delaying Retirement: The Hidden Goldmine

- Increased Savings:

Building a Stronger Financial Foundation- One of the most significant advantages of delaying retirement is the ability to increase your savings. By continuing to work, you can boost your retirement funds through additional contributions, employer benefits, and reduced withdrawals, creating a more secure financial future.

- Key Ways Delayed Retirement Increases Savings:

- Extended Contributions to Retirement Accounts:

Working longer allows you to continue contributing to retirement accounts like 401(k)s or IRAs, maximizing tax-advantaged savings.- Example: Contributing an additional $10,000 annually for five years with a 7% annual return adds nearly $58,000 to your retirement fund.

- Extended Contributions to Retirement Accounts:

- Compounding Growth:

Additional years of investment growth amplify the power of compound interest. Even without extra contributions, delaying withdrawals allows your existing portfolio to grow.- Example: A $500,000 portfolio growing at 6% annually for five extra years becomes $670,000, adding $170,000 without withdrawals.

- Reducing Withdrawals:

Delaying retirement means you’re less reliant on your savings for living expenses, preserving your nest egg and reducing the risk of outliving your funds. - Additional Employer Contributions:

Many employers continue to match contributions to retirement accounts, adding to your savings.- Example: If your employer matches 5% of a $100,000 salary, that’s an extra $5,000 annually for five years.

- Real-Life Financial Impact:

- Delaying retirement by five years with consistent savings and compounding can increase total retirement funds by 15–25%, depending on market conditions and contributions.

- This increased financial cushion provides flexibility, reduces stress, and creates more options for enjoying your golden Years.

- Reduced Risk of Longevity Issues:

Securing a Financially Stable Future- One of the primary concerns for retirees is outliving their savings. With increasing life expectancy, it’s crucial to plan for a longer retirement period. Delaying retirement not only helps grow your financial reserves but also mitigates the risk of longevity issues, ensuring you have sufficient resources to sustain your lifestyle throughout your later years.

- How Delayed Retirement Reduces Longevity Risks:

- More Time to Build Savings:

- By continuing to work, you extend the accumulation phase of your retirement savings. This results in a larger nest egg and reduces the likelihood of running out of funds during an extended retirement.

- Example: Delaying withdrawals by just five years can increase your retirement balance by 15–25%, thanks to ongoing contributions and compounding growth.

- Shorter Retirement Period:

- Delaying retirement reduces the number of years you’ll rely on your savings. For example:

- Retiring at 65 might mean 25+ years of expenses if you live to 90.

- Retiring at 70 reduces this to 20 years, significantly easing the strain on your savings.

- Delaying retirement reduces the number of years you’ll rely on your savings. For example:

- Delayed Social Security Withdrawals:

- Postponing Social Security benefits increases your monthly payout, providing a steady income stream to complement your savings.

- Example: Claiming benefits at 70 instead of 67 can boost payments by up to 24%, helping offset longevity-related financial risks.

- More Time to Build Savings:

- Opportunity to Cover Healthcare Costs:

- Working longer often means maintaining employer-sponsored health benefits, reducing the need for early withdrawals to cover medical expenses.

- Impact on Retirement Planning:

- By delaying retirement, you align your financial resources with a potentially longer lifespan, providing:

- Greater peace of mind.

- Enhanced flexibility to handle unexpected expenses, such as medical bills or long-term care.

- More opportunities to enjoy your golden years without the stress of financial insecurity.

- Opportunities for a Second Career or Passion Project:

Delaying retirement doesn’t mean sticking to the same job—mention options for part-time work, consulting, or starting a business.

Considerations Before Delaying Retirement

- Health Conditions:

A Critical Consideration for Delaying Retirement- While delaying retirement offers significant financial and personal benefits, it’s important to acknowledge that this decision may not be ideal for everyone. Health conditions, both physical and mental, can play a crucial role in determining whether extending your working years is feasible or advisable.

- How Health Issues Can Impact Delaying Retirement:

- Physical Limitations:

Chronic illnesses or conditions such as arthritis, heart disease, or mobility issues can make continuing to work physically challenging, especially in demanding jobs. - Mental Health Challenges:

Stress, burnout, or cognitive decline might affect the ability to perform at work or maintain a healthy work-life balance. For some, the workplace could exacerbate these conditions. - Access to Healthcare:

While employer-sponsored health insurance is a significant advantage of staying employed, individuals with severe health issues may prioritize early retirement to focus on treatment and recovery.

- Physical Limitations:

- Quality of Life Considerations:

Those facing terminal or progressive illnesses might choose to retire earlier to spend time with loved ones or pursue personal goals. - Balancing Health and Financial Needs:

- Consult Healthcare Providers: Discuss your condition with medical professionals to determine whether continuing to work aligns with your health needs.

- Consider Part-Time Work or Flexible Roles: Transitioning to less demanding positions can offer a compromise between maintaining income and addressing health concerns.

- Leverage Disability Benefits: Explore options like Social Security Disability Insurance (SSDI) or employer-sponsored disability plans if health conditions prevent you from working.

- Key Takeaway:

- Delaying retirement can be an excellent strategy for many, but it’s not a one-size-fits-all solution. Prioritizing health and quality of life is essential when deciding the best course for your future. Tailoring the decision to your personal circumstances ensures a more fulfilling and balanced retirement journey.

- Work-Life Balance:

Finding Harmony in Delayed Retirement- While delaying retirement can provide significant financial and health benefits, it’s essential to balance these advantages with personal happiness and quality time with loved ones. A strong work-life balance ensures that the decision to work longer doesn’t come at the cost of well-being or family connections.

- Why Work-Life Balance Matters:

- A voiding Burnout:

Working longer can lead to physical and mental exhaustion, especially in high-stress jobs. Striking a balance between work demands and personal time is critical for maintaining overall health. - Spending Time with Family:

Delayed retirement may reduce opportunities to create lasting memories with family and friends. Prioritizing time for loved ones ensures that relationships remain strong and fulfilling. - Pursuing Personal Passions:

Life isn’t solely about work. Taking time to engage in hobbies, travel, or creative pursuits adds joy and richness to your life, making extended working years more meaningful. - Mental and Emotional Well-Being:

A healthy work-life balance contributes to reduced stress and greater satisfaction. It also helps in maintaining a positive outlook, which is vital as you approach your golden years.

- Tips for Maintaining Balance While Working Longer:

- Set Boundaries: Avoid overcommitting to work. Define clear limits to protect your personal time and mental space.

- Flexible Work Options: Explore part-time, remote, or consulting roles to enjoy the financial benefits of working without compromising personal happiness.

- Prioritize Self-Care: Make time for exercise, healthy eating, and mindfulness practices to stay physically and mentally resilient.

- Plan Quality Time: Schedule regular moments with family and friends to ensure meaningful connections.

- The Bottom Line:

- Delaying retirement can be a smart financial move, but it’s crucial to ensure that it doesn’t overshadow personal fulfillment. A well-balanced approach allows you to reap the rewards of working longer while preserving the joy and connections that make life truly rich.

- While delaying retirement can provide significant financial and health benefits, it’s essential to balance these advantages with personal happiness and quality time with loved ones. A strong work-life balance ensures that the decision to work longer doesn’t come at the cost of well-being or family connections.

- Strategic Planning:

The Role of a Financial Advisor in Delayed Retirement- Delaying retirement is a powerful strategy, but it requires careful planning to ensure you’re making the most of the additional working years. Consulting a financial advisor can help you tailor your approach to align with your unique goals, financial situation, and long-term needs.

- Why Strategic Planning Matters:

- Optimizing Savings and Investments:

A financial advisor can help you determine the right mix of investments to maximize returns while minimizing risks during your extended working years. - Maximizing Social Security Benefits:

Advisors can calculate the optimal time to claim Social Security benefits based on your income, savings, and life expectancy.- Example: Delaying benefits until age 70 increases payouts by up to 24%, which can significantly impact your retirement income.

- Creating a Comprehensive Retirement Plan:

A professional can evaluate your current savings, projected expenses, and additional contributions to ensure your retirement funds will sustain you for the long haul. - Addressing Tax Implications:

Working longer may impact your tax situation. An advisor can suggest strategies to minimize taxes, such as Roth conversions or tax-efficient withdrawal plans. - Balancing Work and Lifestyle:

Beyond finances, a financial advisor can help you weigh the trade-offs of working longer against personal goals, ensuring your plan aligns with your desired lifestyle.

- Optimizing Savings and Investments:

- Why Strategic Planning Matters:

- Steps to Take with a Financial Advisor:

- Conduct a Financial Health Check: Assess current savings, income streams, and debt to understand your starting point.

- Set Retirement Goals: Define your target retirement age, lifestyle preferences, and financial objectives.

- Evaluate Scenarios: Review “what if” scenarios, such as retiring earlier or delaying withdrawals, to see how they impact your overall plan.

- Adjust Investments: Shift your portfolio to balance growth with security as you approach retirement.

- Key Takeaway:

- Strategic planning is essential to maximize the benefits of delayed retirement. Consulting a financial advisor ensures you’re making informed decisions that not only enhance your financial future but also align with your personal and lifestyle goals. This partnership can turn your extended working years into a steppingstone toward a more prosperous and fulfilling retirement on consulting a financial advisor to make the most of this strategy.

- Delaying retirement is a powerful strategy, but it requires careful planning to ensure you’re making the most of the additional working years. Consulting a financial advisor can help you tailor your approach to align with your unique goals, financial situation, and long-term needs.

Conclusion

Delaying retirement isn’t just a financial strategy—it’s a transformative decision that can reshape your future. By waiting a few extra years, you can significantly increase your Social Security benefits, boost your retirement savings, and enjoy the advantages of employer-sponsored benefits for a longer period. For example, delaying your Social Security claim until age 70 could mean an 8% annual increase in benefits, translating to tens of thousands of dollars over a lifetime. Similarly, those who continue contributing to retirement accounts during this period can potentially see their savings grow by 25–40% due to compounding returns.

Beyond the financial perks, delaying retirement offers a wealth of non-monetary benefits. Staying active in the workforce promotes mental sharpness, physical health, and a sense of purpose—all of which are linked to improved longevity and overall happiness. Research shows that individuals who delay retirement by just three to five years can reduce their risk of outliving their savings by as much as 50%.

Ultimately, Why Delayed Retirement Could Be a Hidden Goldmine for Your Future comes down to more than just money—it’s about securing a future filled with financial stability, personal fulfillment, and opportunities for growth. Whether it’s through maximizing your financial potential, staying mentally engaged, or pursuing passion projects, delaying retirement could be the key to unlocking a golden and prosperous future. So, if you’re considering your options, remember that Why Delayed Retirement Could Be a Hidden Goldmine for Your Future is a choice worth exploring for the long-term benefits it brings. [FinansieraTrading.com]