Introduction Why the FIRE movement is reshaping retirement in the USA has become one of the most transformative questions in modern financial planning. This groundbreaking approach emphasizes financial independence and early retirement through disciplined savings, frugal living, and smart investments. As more Americans seek alternatives to traditional retirement, the FIRE movement’s influence continues to grow. Recent surveys reveal that 58% of individuals under 40 are familiar with FIRE, and many are adopting its principles to retire decades earlier than the national average retirement age of 64. This blog delves into the driving factors behind this lifestyle revolution and examines how it’s reshaping retirement for a new generation of Americans.

Understanding the FIRE Movement To understand why the FIRE movement is gaining traction, it’s crucial to examine its core principles and methodology.

Table of Contents

- What is FIRE (Financial Independence, Retire Early)? FIRE is a lifestyle and financial strategy aimed at achieving early retirement by accumulating sufficient wealth to live off passive income.

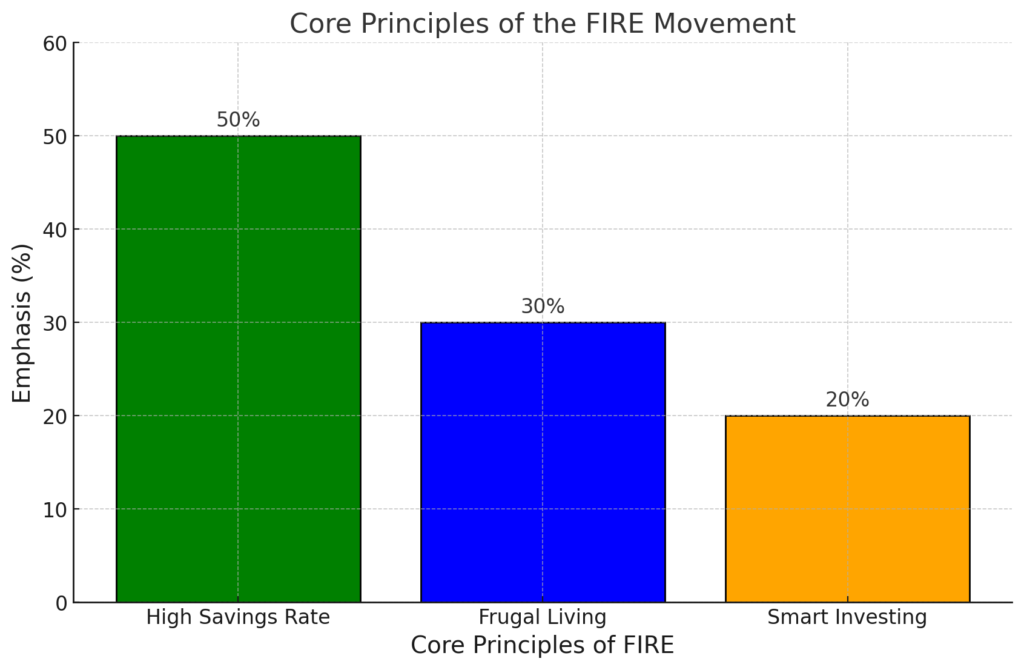

- Key Components of FIRE:

- High savings rate (50% or more of income).

- Minimalistic and frugal lifestyle choices.

- Smart investments in index funds, real estate, or other passive income-generating assets.

Why the FIRE Movement Is Reshaping Retirement in the USA

Economic Shifts and Financial Security

- Rising concerns over the sustainability of Social Security and traditional pension systems are prompting individuals to take control of their financial futures.

- The COVID-19 pandemic highlighted the importance of financial resilience and emergency funds, pushing FIRE principles into the spotlight.

- Inflation and increasing healthcare costs are driving Americans to save and invest aggressively.

Cultural Shifts Toward Minimalism and Freedom

- Millennials and Gen Z prioritize experiences over material possessions, aligning perfectly with the frugal lifestyle advocated by FIRE.

- The gig economy and remote work options enable flexible income streams, making early retirement more achievable.

- A growing emphasis on mental health and work-life balance encourages individuals to seek financial independence earlier.

Data Supporting the Growth of FIRE

- According to a survey by TD Ameritrade, nearly 58% of Americans under 40 are familiar with the FIRE movement.

- Studies show that individuals pursuing FIRE save an average of 30%-70% of their income.

- The average age of retirees within the FIRE community ranges from 35 to 50, compared to the national retirement age of 64.

Strategies to Achieve FIRE (Financial Independence, Retire Early)

Frugal Living

- Cut unnecessary expenses by adopting minimalist lifestyles.

- Embrace budgeting tools and apps to monitor and reduce spending.

Maximizing Income Streams

- Pursue high-paying careers or side hustles.

- Invest in passive income avenues like rental properties or dividend stocks.

Smart Investment Planning

- Diversify investments across index funds, ETFs, and real estate.

- Leverage tax-advantaged accounts like 401(k)s and IRAs to maximize returns.

Impact of FIRE on Traditional Retirement Models

Shifting Perspectives on Retirement Age

- FIRE challenges the norm of retiring in one’s 60s, inspiring earlier exits from the workforce.

- Early retirees often pursue passion projects, volunteer work, or part-time employment, redefining the concept of “retirement.”

Influence on Financial Planning Industries

- Financial advisors now cater to FIRE followers with tailored plans focusing on aggressive savings and alternative investments.

- Companies are creating FIRE-specific financial tools and calculators to aid individuals in their journeys.

Where to Add Images and Graphics

Challenges of the FIRE (Financial Independence, Retire Early) Movement

Criticism of Extreme Frugality

- Critics argue that FIRE’s emphasis on extreme frugality can compromise quality of life.

- Not everyone can sustain a high savings rate, especially in lower-income brackets.

Market Dependency

- Heavy reliance on investments makes FIRE vulnerable to market volatility.

- A market crash during early retirement can jeopardize financial stability.

Healthcare and Longevity Risks

- Early retirees often face challenges accessing affordable healthcare before Medicare eligibility.

- Longevity risk—outliving one’s savings—is a significant concern.

Conclusion

The FIRE movement is reshaping retirement in the USA by providing individuals with a path to financial independence and early retirement. With 58% of Americans under 40 already familiar with the movement, its principles of aggressive savings, frugal living, and smart investing are transforming traditional retirement models. As the average retirement age in the FIRE community falls between 35 and 50, compared to the national average of 64, it’s evident that this movement is gaining momentum. However, pursuing FIRE requires careful planning to address challenges such as healthcare costs and market dependency. By understanding why, the FIRE movement is reshaping retirement in the USA, individuals can take proactive steps to secure their financial futures and redefine what retirement means for generations to come.