Retirement Savings Tips for Late Starters: A Comprehensive Guide

Starting late on your retirement savings can feel overwhelming, but it’s never too late to take control of your financial future. Whether you’ve faced unexpected life changes, career shifts, or simply delayed planning, the good news is that you still have time to build a secure retirement.

This guide will walk you through practical strategies and essential components to strengthen your retirement savings, no matter when you start. With the right mindset and actionable steps, you can catch up and create the retirement you deserve.

Table of Contents

The Importance of Starting Now

When it comes to retirement savings, time is a powerful asset. Even if you’re starting late, the urgency can work in your favor by motivating you to take immediate and focused action. Starting now allows you to:

- Maximize the time left for saving and investing.

- Take advantage of compounding interest.

- Establish disciplined saving habits that can significantly improve your financial outlook.

Assess Your Current Financial Situation

Understanding your financial baseline is the first step in any retirement plan. Here’s how to get started:

- Calculate Your Net Worth: Subtract your liabilities (debts) from your assets (savings, investments, property).

- Review Income Sources: Include salaries, side gigs, and any existing retirement accounts like 401(k)s or IRAs.

- Track Monthly Expenses: Identify areas where you can cut costs and redirect funds into retirement savings.

By knowing where you stand financially, you can create a realistic plan to catch up on your retirement goals.

Set Realistic Retirement Goals

Setting achievable retirement goals gives you a clear target to work toward. Consider the following:

- Lifestyle: Where will you live? What activities will you enjoy?

- Expenses: Estimate future costs for housing, healthcare, and travel.

- Savings Target: Use retirement calculators to determine how much you’ll need to save.

Having a clear vision of your retirement will guide your investment and budgeting strategies.

Maximize Retirement Account Contributions

To make up for lost time, contribute as much as possible to tax-advantaged retirement accounts. Here’s how:

- 401(k) or 403(b): Contribute the maximum limit, especially if your employer offers matching contributions—it’s essentially free money.

- IRAs: Consider traditional or Roth IRAs for additional tax benefits.

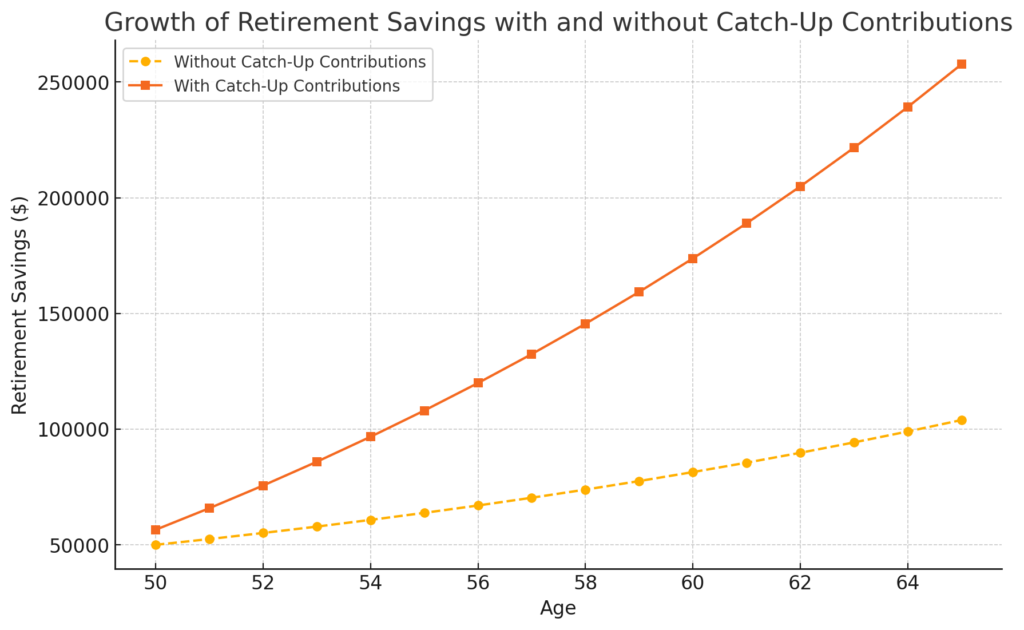

- Catch-Up Contributions: If you’re 50 or older, take advantage of higher contribution limits.

Diversify Your Investment Portfolio

Diversification is key to managing risk and maximizing returns. Here’s how to build a balanced portfolio:

- Mix of Assets: Invest in stocks, bonds, and mutual funds.

- Low-Cost Index Funds and ETFs: These offer broad market exposure with minimal fees.

- Adjust Over Time: Shift to more conservative investments as you near retirement to protect your savings from market volatility.

Reduce Debt and Minimize Expenses

High-interest debt can drain your resources and limit your ability to save. Focus on:

- Paying Down Debt: Prioritize credit cards and personal loans.

- Cutting Expenses: Downsize your home, refinance your mortgage, or eliminate unnecessary spending.

- Frugal Living: Adopting a simpler lifestyle now can lead to greater financial security later.

Consider Additional Income Streams

Supplementing your income can accelerate your retirement savings. Explore options like:

- Part-Time Work or Freelancing: Leverage your skills for extra income.

- Monetizing Hobbies: Turn passions into profit.

- Passive Income: Invest in rental properties or dividend-paying stocks.

Optimize Social Security Benefits

When you claim Social Security can significantly impact your benefits. Consider:

- Full Retirement Age: Waiting until your full retirement age (or later) can increase your monthly benefit.

- Health and Earnings: Factor in your current earnings and health status when deciding when to claim.

A well-planned strategy can maximize your lifetime Social Security income.

Seek Professional Financial Advice

If you’re unsure where to start or how to optimize your retirement plan, consulting a financial advisor can be invaluable. A professional can help you:

- Create a personalized strategy based on your unique financial situation.

- Navigate complex decisions like tax planning and estate planning.

- Stay on track with your retirement goals.

Conclusion

Securing your retirement, even if you’re starting late, is entirely possible with the right strategies in place. By assessing your current financial situation, maximizing contributions, diversifying your investments, and considering additional income streams, you can build a stable financial future.

Remember, every step you take today is an investment in your tomorrow. Don’t wait—start planning now, seek professional advice if needed, and stay committed to your financial goals.

Call to Action: What actions will you take today to secure your retirement? Share your thoughts in the comments and explore FinansieraTrading.com / AARP’s for additional guidance.

Stay motivated, because it’s never too late to build the retirement you deserve.