Why Retirees Regret Not Building Multiple Income Streams Earlier: A Guide to Financial Freedom

Retirement is often painted as a golden period of life—a time to relax, travel, and enjoy the fruits of decades of hard work. However, for many retirees, this dream is overshadowed by financial stress and regret. A growing number of retirees wish they had built multiple income streams earlier in life, as relying solely on savings, pensions, or Social Security has left them struggling to make ends meet. In this comprehensive guide, we’ll dive deep into why retirees regret not diversifying their income, the benefits of multiple income streams, and actionable steps you can take today to secure your financial future.

Table of Contents

The Harsh Reality: Why Retirees Regret Their Financial Choices

Recent studies and surveys reveal that nearly 60% of retirees express regret over not building additional income streams during their working years. Many assumed their savings or a single pension would suffice, only to face the harsh realities of inflation, rising healthcare costs, and unexpected expenses.

For example, a 2023 survey by the Employee Benefit Research Institute (EBRI) found that 40% of retirees are forced to cut back on essential expenses, while 25% have returned to work part-time to supplement their income. These statistics highlight the importance of diversifying income sources long before retirement.

Why Multiple Income Streams Are Crucial for Retirement

Building multiple income streams isn’t just a luxury—it’s a necessity in today’s unpredictable economy. Here’s why:

- Financial Security: Diversifying income reduces reliance on a single source, providing a safety net during economic downturns.

- Inflation Protection: Multiple income streams can help combat the eroding effects of inflation on fixed incomes like pensions or savings.

- Flexibility: Whether it’s rental income, dividends, or a side business, additional income streams offer flexibility to adapt to changing circumstances.

Lessons from Retirees: What Went Wrong?

Retirees who regret their financial choices often share common mistakes:

- Starting Too Late: Many waited until their 50s or 60s to think about additional income, leaving little time to build sustainable streams.

- Overestimating Savings: Some retirees underestimated how long their savings would last, failing to account for rising costs and longer lifespans.

- Ignoring Passive Income: Opportunities like investing in stocks, real estate, or creating digital products were often overlooked.

How to Build Multiple Income Streams: Actionable Tips

If you’re still in the workforce or planning for retirement, now is the time to act. Here are proven strategies to diversify your income:

1. Invest in Real Estate

Rental properties can provide a steady monthly income. For example, purchasing a duplex and renting out one unit can cover your mortgage while generating extra cash.

2. Explore the Gig Economy

Freelancing, consulting, or part-time work can supplement your primary income. Platforms like Upwork or Fiverr make it easy to monetize your skills.

3. Build Passive Income Streams

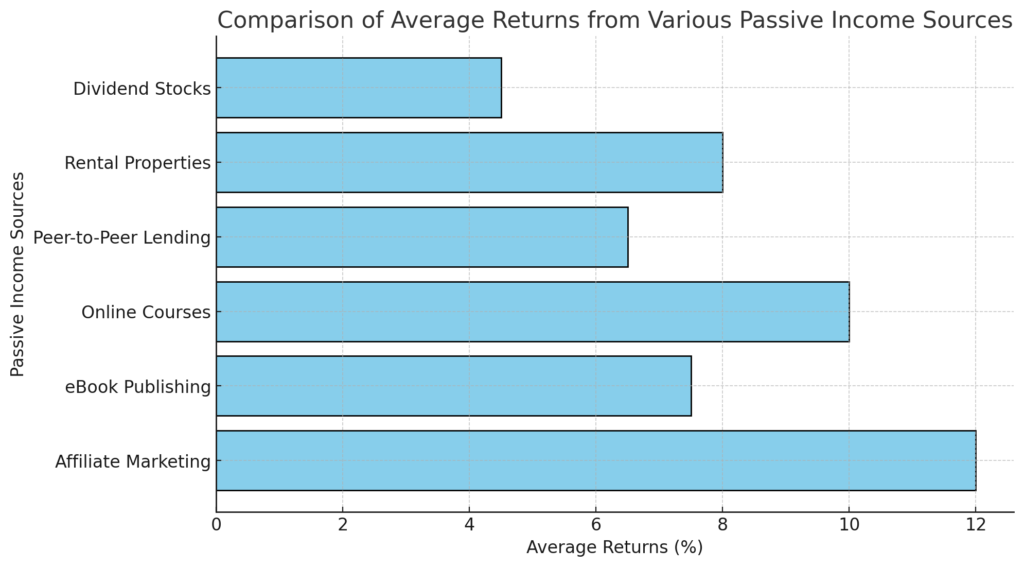

- Dividend-Paying Stocks: Invest in companies that pay regular dividends.

- Peer-to-Peer Lending: Earn interest by lending money through platforms like LendingClub.

- Create Digital Products: Write an eBook, design templates, or create an online course.

4. Start a Side Business

Turn a hobby or passion into a profitable venture. For instance, if you love baking, consider selling baked goods locally or online.

Conclusion

The regret felt by retirees who failed to build multiple income streams serves as a powerful lesson for younger generations. Financial security in retirement requires proactive planning, diversification, and a willingness to explore unconventional income sources. By taking action now, you can ensure a more comfortable and stress-free retirement. [FinansieraTrading.com]