In today’s rapidly changing economic landscape, Why Having a Financial Plan Matters More Than Ever in the USA is a question that every American should consider seriously. With inflation at its highest in decades, rising healthcare costs, and increasing uncertainty in the job market, financial planning is no longer optional—it’s essential. Whether you’re striving to buy your first home, save for your child’s education, or ensure a comfortable retirement, having a solid financial plan helps you stay prepared for whatever life throws your way.

Many Americans struggle with managing their finances, often feeling overwhelmed by debt, unexpected expenses, or the complexities of investment options. A well-crafted financial plan acts as a roadmap, guiding you through these challenges and helping you make informed decisions that align with your goals. In this blog post, we’ll explore why financial planning has never been more crucial, the key elements of a successful plan, and actionable steps you can take to secure your financial future.

By the end of this article, you’ll have a clear understanding of how a financial plan can empower you to take control of your money, reduce financial stress, and achieve long-term stability. So, let’s dive in and discover why having a financial plan matters more than ever in the USA.

Why Financial Planning is Critical in the USA Today

Discuss the current financial challenges in the USA, such as:

- Rising inflation and its impact on savings.

- Increasing cost of healthcare and education.

- Economic uncertainty post-pandemic.

- Importance of adapting to financial trends like AI-driven investment platforms.

Components of a Solid Financial Plan

Break down the essential elements of a financial plan, including:

- Budgeting and Expense Tracking

Explain the importance of maintaining a budget and how it helps individuals understand their spending habits and save effectively. - Savings and Emergency Funds

Emphasize building an emergency fund to cover at least 3–6 months of expenses for unforeseen events. - Debt Management

Offer insights into consolidating and paying off high-interest debts as part of a long-term plan. - Investing for the Future

Cover investment strategies like retirement accounts (401(k), IRAs), stocks, and mutual funds.

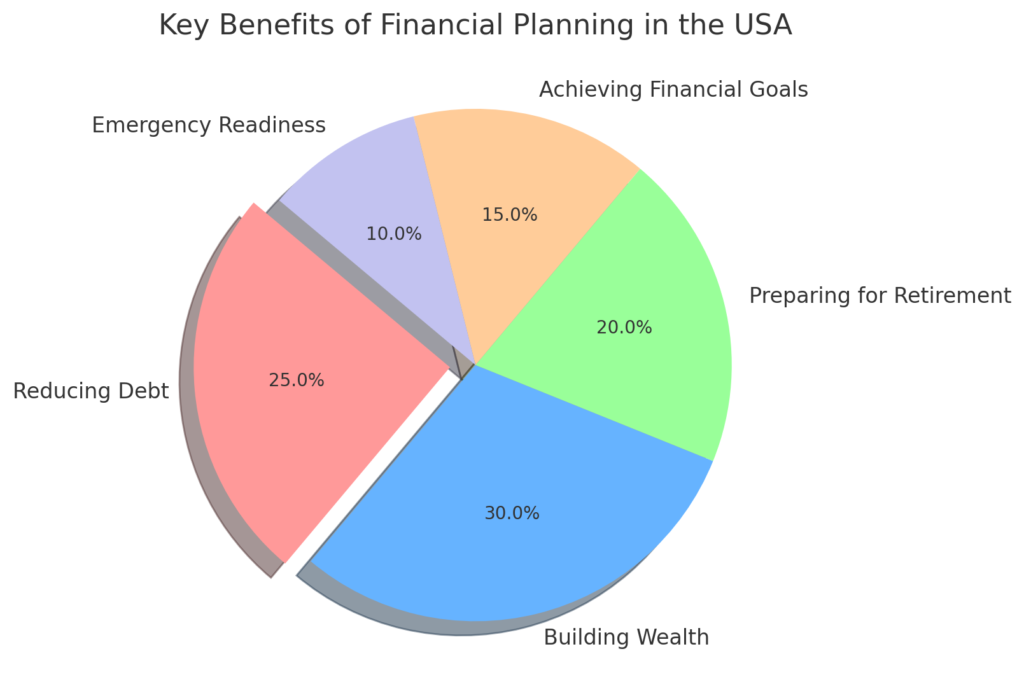

Benefits of Financial Planning in the USA

Discuss how financial planning helps:

- Secure a comfortable retirement.

- Reduce financial stress and anxiety.

- Protect against unforeseen expenses (health, car repairs, etc.).

- Achieve personal goals like home ownership, travel, or starting a business.

Steps to Start Your Financial Plan

- Assess Your Financial Situation

Discuss reviewing income, expenses, assets, and liabilities. Suggest tools like budgeting apps. - Set Clear Goals

Provide examples of short-term (paying off credit cards) vs. long-term goals (saving for a child’s college). - Seek Professional Help

Highlight the importance of consulting financial advisors or using online tools for tailored advice.

Common Financial Planning Mistakes to Avoid

- Ignoring the importance of an emergency fund.

- Failing to account for inflation in retirement planning.

- Not reviewing and updating the plan periodically.

- Over-relying on credit and accruing high-interest debt.

Conclusion: Why Having a Financial Plan Matters More Than Ever in the USA

In conclusion, Why Having a Financial Plan Matters More Than Ever in the USA cannot be overstated in today’s fast-paced and unpredictable financial landscape. With inflation rates averaging around 3.5% annually, increasing healthcare costs, and economic uncertainties, having a well-structured financial plan provides a critical roadmap for achieving financial security and long-term success. Whether it’s preparing for unexpected emergencies, securing a comfortable retirement, or simply achieving life goals like homeownership or debt freedom, a sound financial strategy empowers individuals to take control of their future.

By following the steps outlined—assessing your financial situation, setting clear goals, budgeting effectively, and seeking professional advice—you can build a strong financial foundation that withstands economic fluctuations and unforeseen challenges. Remember, financial planning is not just for the wealthy; it’s a tool that benefits everyone, from young professionals to retirees.

Now is the perfect time to take action and start your journey toward financial independence. Reflect on your current financial position, implement the strategies discussed, and begin building a future where financial stress is a thing of the past. Share your thoughts in the comments below or explore our other articles for more insights on why having a financial plan matters more than ever in the USA.

Take charge of your financial future today—because planning now means securing tomorrow. [FinansieraTrading.com]