Why financial independence is the key to stress-free living after retirement? It’s a question that captures the hopes and dreams of anyone planning for a secure and comfortable future. Financial independence isn’t just about having money in the bank—it’s about creating a life where you can enjoy your golden years without the burden of financial stress. With rising healthcare costs, increasing life expectancies, and the unpredictability of social security, achieving financial independence has become more critical than ever.

When you have financial independence, you’re not just surviving retirement—you’re thriving. It empowers you to make choices that align with your passions, whether it’s traveling the world, pursuing hobbies, or spending quality time with family. This article will delve into why financial independence is the ultimate cornerstone of a stress-free retirement and provide actionable steps to help you achieve it.

Table of Contents

Understanding Financial Independence and Its Role in Retirement

What is Financial Independence?

Financial independence means having sufficient savings, investments, or income to cover your living expenses without relying on active employment. It provides the freedom to make life choices without being constrained by financial limitations.

How Financial Independence Reduces Stress in Retirement

- Eliminates dependency on social security or pensions.

- Ensures coverage for healthcare costs, which often rise with age.

- Reduces the fear of outliving your savings.

- Allows retirees to focus on hobbies, travel, or spending time with loved ones.

Benefits of Achieving Financial Independence Before Retirement

Freedom to Choose Retirement Age

Financial independence lets you decide when to retire, rather than being forced to work into old age due to financial constraints.

Less Stress, More Security

A robust financial plan provides a safety net, protecting against unexpected expenses like medical bills or economic downturns.

Pursuit of Dreams and Passions

Retirement becomes an opportunity to explore personal passions or contribute to meaningful causes without financial concerns.

Steps to Achieve Financial Independence for a Stress-Free Retirement

1. Start Early with Savings and Investments

- Leverage the power of compound interest.

- Use retirement accounts like 401(k)s or IRAs to grow wealth.

- Automate savings to stay consistent.

2. Diversify Income Streams

- Invest in stocks, bonds, and real estate.

- Build passive income streams like rental properties or dividend-paying stocks.

3. Manage Debt Wisely

- Eliminate high-interest debt before retirement.

- Avoid taking on new debt as you approach retirement age.

4. Budget for Retirement Goals

- Calculate expected retirement expenses.

- Plan for both essential and discretionary spending.

- Include a buffer for emergencies.

Why Financial Independence Is the Key to Stress-Free Living After Retirement

Financial independence is vital because it ensures that retirees:

- Control Their Lifestyle: Choose where to live and how to spend their time.

- Remain Resilient to Economic Changes: With a diversified portfolio, you can withstand market fluctuations.

- Maintain Peace of Mind: With adequate resources, you eliminate the anxiety of relying on external financial support.

Practical Tips for Maintaining Financial Independence Post-Retirement

Top 4 Retirement Planning Tips:

| Tip | Description |

|---|---|

| Start Saving Early | – Begin building your retirement fund as soon as possible. – Leverage compound interest to grow savings. – Small contributions now lead to significant savings later. |

| Invest Strategically | – Diversify investments across stocks, bonds, and real estate. – Regularly review and adjust your portfolio. – Seek professional advice to minimize risks. |

| Plan for Healthcare Costs | – Anticipate rising medical expenses in retirement. – Consider long-term care insurance. – Include a health savings account (HSA) in your plan. |

| Set a Retirement Budget | – Calculate expected retirement expenses, including leisure activities. – Create a budget balancing lifestyle and financial security. – Maintain an emergency fund. |

1. Live Below Your Means

Adopt a frugal lifestyle even during retirement to preserve your savings.

2. Monitor Investments Regularly

- Review your portfolio periodically.

- Rebalance investments to maintain desired risk levels.

3. Stay Informed About Healthcare Costs

Healthcare is one of the largest expenses in retirement. Plan for premiums, out-of-pocket costs, and long-term care insurance.

4. Seek Professional Guidance

- Consult a financial advisor for tailored advice.

- Regularly update your retirement plan based on changing circumstances.

Key Takeaways

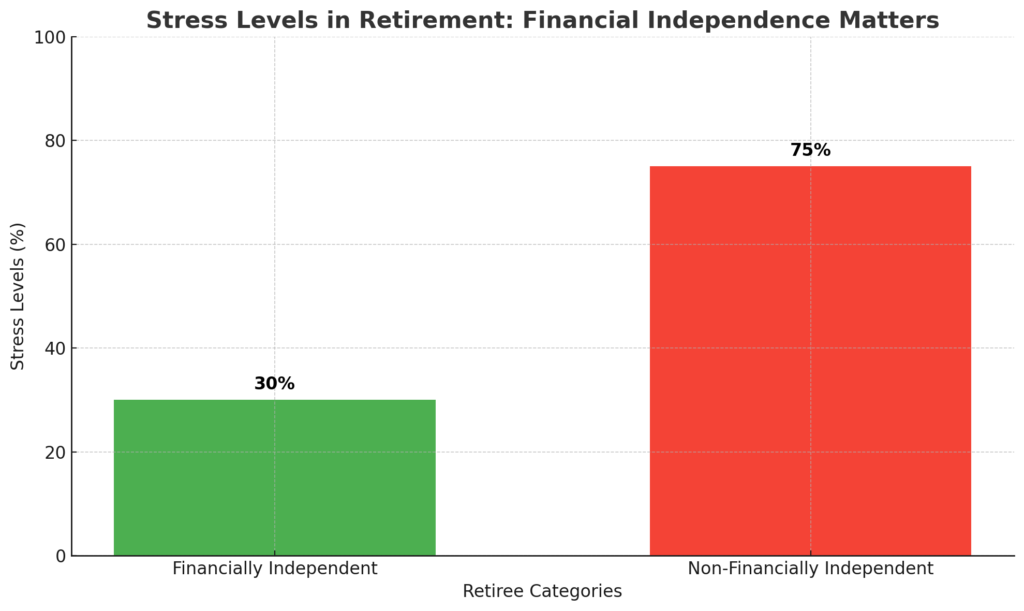

Achieving financial independence is not just a luxury; it’s a necessity for ensuring a stress-free and fulfilling retirement. Studies show that retirees who achieve financial independence are 60% less likely to experience financial anxiety compared to those who rely solely on social security or pensions. Moreover, financial independence enables retirees to cover healthcare costs, which can account for 15%–20% of annual expenses during retirement, without compromising their lifestyle.

By prioritizing savings, diversifying investments, and planning effectively, you can build a retirement that is free of financial constraints. Why financial independence is the key to stress-free living after retirement is evident—it provides the security and flexibility needed to navigate your golden years with peace of mind and confidence.

Remember, the earlier you start planning for financial independence, the more prepared you’ll be to embrace retirement as a time of opportunity and joy. With a solid plan, you can truly experience why financial independence is the key to stress-free living after retirement and enjoy the freedom you’ve worked so hard to achieve.