Why emergency funds are a lifeline you can’t ignore is a lesson many people learn the hard way. Life is unpredictable, and unexpected expenses like medical bills, car repairs, or sudden job loss can strike when you least expect them. Without a financial safety net, these emergencies can lead to mounting debt, disrupted financial goals, and unnecessary stress.

An emergency fund acts as your financial armor, shielding you from life’s uncertainties and giving you peace of mind. It’s not just about surviving tough times; it’s about thriving and staying in control even when the unexpected happens. Whether you’re just starting your savings journey or looking to strengthen your financial foundation, this guide will help you understand why emergency funds are essential and how you can create one to secure your future.

Table of Contents

What is an Emergency Fund?

An emergency fund is a dedicated savings account that acts as a financial safety net for unexpected expenses like medical emergencies, car repairs, or sudden unemployment. Unlike other savings, this fund is specifically meant for unforeseen costs, ensuring you’re not caught off guard.

Why Emergency Funds Are a Lifeline You Can’t Ignore

Emergencies strike without warning, and here’s why having an emergency fund is non-negotiable:

- Avoiding Debt: Without an emergency fund, you may rely on credit cards or loans, leading to high-interest payments.

- Financial Stability: A safety net keeps your long-term financial goals on track, even during tough times.

- Peace of Mind: Knowing you’re prepared reduces stress and allows you to focus on resolving the crisis.

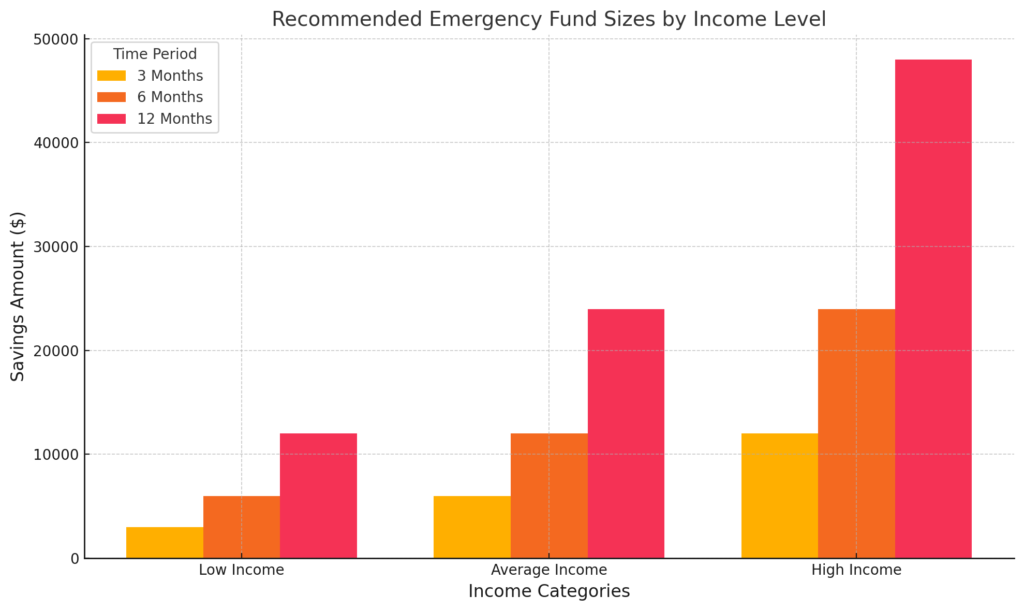

How Much Should You Save?

Experts recommend saving three to six months’ worth of living expenses. However, the ideal amount depends on your lifestyle, income stability, and responsibilities.

Steps to Build an Emergency Fund

- Set a Savings Goal: Calculate your monthly expenses, including rent, utilities, groceries, and transportation. Multiply this by three or six months to determine your target amount.

- Open a Dedicated Account: Keep your emergency fund separate from other savings to avoid temptation.

- Automate Your Savings: Set up automatic transfers to your emergency fund each payday.

- Start Small: Begin with manageable contributions. Even saving $50 a month adds up over time.

- Cut Unnecessary Expenses: Identify areas where you can reduce spending and redirect that money to your fund.

When to Use Your Emergency Fund

An emergency fund is for true financial emergencies, such as:

- Medical bills not covered by insurance.

- Urgent home repairs, like fixing a leaking roof.

- Job loss or unexpected income gaps.

Avoid using it for non-emergencies like vacations, shopping sprees, or planned expenses.

Common Mistakes to Avoid

- Not Saving Enough: Underestimating your needs can leave you vulnerable.

- Using the Fund for Non-Essentials: Treat it as untouchable unless a real emergency arises.

- Skipping Replenishment: Once you use your fund, prioritize rebuilding it immediately.

Benefits of an Emergency Fund

Emergency funds offer financial and psychological advantages, including:

- Reduced Stress: Knowing you’re prepared can help you sleep better at night.

- Flexibility: Provides financial breathing room without relying on credit.

- Long-Term Financial Health: Protects your retirement savings and investment portfolio.

Final Thoughts: Building a Lifeline for the Unexpected

Building an emergency fund isn’t just a financial goal—it’s a necessity that can save you from financial turmoil. According to a recent survey by the Federal Reserve, nearly 40% of Americans would struggle to cover a $400 unexpected expense without borrowing money. This stark statistic highlights why emergency funds are a lifeline you can’t ignore.

An emergency fund provides a buffer against life’s unpredictability, ensuring you can manage medical bills, job loss, or urgent repairs without spiraling into debt. With just $50 a week saved consistently; you could build a $2,600 emergency fund in just one year—enough to handle many common emergencies.

Remember, why emergency funds are a lifeline you can’t ignore isn’t just about financial security; it’s about achieving peace of mind, protecting your future, and staying resilient during challenging times. Start your emergency fund today—it’s an investment in yourself and your financial well-being. [FinansieraTrading.com]