Why Credit Card Rewards Might Be Costing You More Than You Think is a question most credit card users fail to ask, dazzled by the promise of free flights, cashback, and exclusive perks. While these rewards programs sound like a win-win, they are often designed to make you spend more, incur higher interest payments, or overlook fees that quietly chip away at your finances. Did you know that a 2023 study revealed 55% of credit cardholders spend more on reward cards compared to non-reward cards, often chasing points they’ll never fully redeem?

In this post, we’ll dive deep into the hidden costs behind credit card rewards and why their glittering appeal can sometimes lead to financial pitfalls. By understanding how these programs are designed and learning how to navigate them effectively, you can ensure that your rewards don’t cost you more than they’re worth. Whether you’re new to credit cards or a seasoned user, this comprehensive guide will help you make informed decisions and keep more money in your pocket.

Table of Contents

The Appeal of Credit Card Rewards

- How Rewards Work: Explain the mechanics of rewards—points, miles, cashback, etc. Highlight their appeal.

- Marketing Psychology: Discuss how card companies design rewards programs to encourage spending.

- Sign-Up Bonuses: Why large bonuses often lure users into opening new accounts.

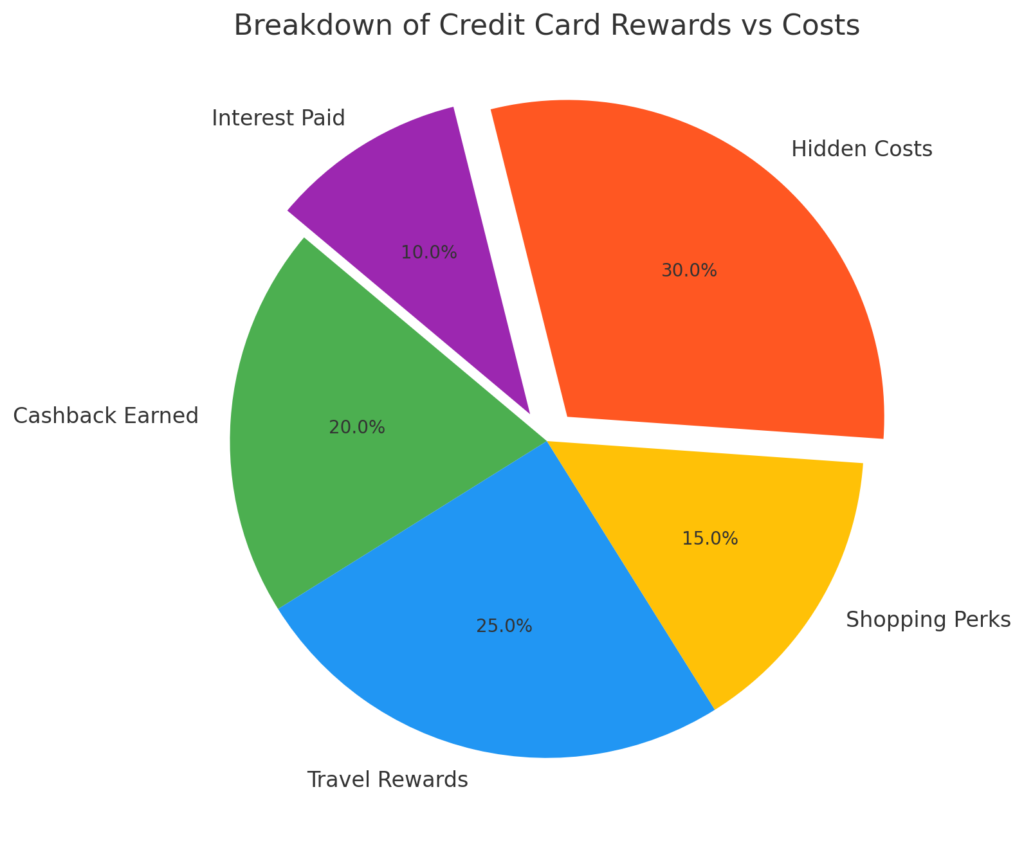

The Hidden Costs Behind Credit Card Rewards

- Higher Spending Habits

- Discuss how rewards incentivize overspending by making users chase points.

- Include data: Studies showing how reward cards lead to an average increase in monthly spending.

- Interest Rates and Debt Traps

- Explain the impact of high-interest rates if users fail to pay the balance in full.

- Mention how rewards can lead to financial losses when interest outweighs perks.

- Annual Fees and Hidden Charges

- Break down common annual fees and how they eat into rewards value.

- List examples of hidden charges like foreign transaction fees or late payment penalties.

Comparison Table: Reward Value vs. Associated Costs

| Category | Value Earned/Cost Incurred | Explanation |

|---|---|---|

| Spending Amount | $5,000 | The total amount spent using the credit card. |

| Rewards Earned | $100 | Cashback or reward points earned (2% rate). |

| Annual Fee | -$95 | Standard annual fee for premium cards. |

| Interest Paid | -$120 | Average interest paid for carrying a balance. |

| Other Fees | -$30 | Hidden costs such as foreign transaction fees. |

| Net Benefit/Loss | – $145 | Rewards earned ($100) minus total costs. |

How Credit Card Rewards Impact Your Financial Habits

- Encouragement of Unnecessary Purchases

- Examples of how people buy things they don’t need to hit spending thresholds for rewards.

- Include anecdotes or brief examples.

- Deferred Financial Goals

- Highlight how overspending impacts savings or debt repayment priorities.

Are Credit Card Rewards Truly Worth It?

- Assessing the Real Value

- Provide a formula for readers to evaluate if rewards justify their spending. Example:

- Rewards earned – (annual fees + interest + hidden costs) = Net value

- Provide a formula for readers to evaluate if rewards justify their spending. Example:

- Examples of Misleading Perks

- Discuss scenarios where rewards don’t align with a user’s lifestyle, like miles on airlines they rarely use.

Practical Tips to Maximize Credit Card Rewards Without Losing Money

- Pay Balances in Full

- Emphasize the importance of avoiding interest charges by paying the entire balance monthly.

- Choose the Right Card

- Align rewards with spending habits (e.g., cashback for everyday expenses, travel rewards for frequent travelers).

- Track Spending

- Use budgeting tools to monitor credit card usage.

- Avoid Overspending

- Provide practical examples of how to stay disciplined, like setting spending caps.

Conclusion

Credit card rewards can be an enticing financial tool, but they often come with hidden pitfalls that can cost you more than you gain. By addressing the critical question of “Why Credit Card Rewards Might Be Costing You More Than You Think,” it’s evident that the allure of points, miles, and cashback can lead to higher spending, interest payments, and overlooked fees.

For example, a study by the Consumer Financial Protection Bureau revealed that over 60% of reward cardholders carry a balance, paying an average of 17% APR on their debt. This interest can far outweigh any rewards earned. Additionally, annual fees for premium reward cards range from $95 to over $500, eating into potential savings if the benefits aren’t fully utilized.

To truly benefit from credit card rewards, you must evaluate whether they align with your spending habits and financial goals. Focus on paying off balances monthly to avoid interest, choose a card with rewards you will actually use, and monitor spending carefully. By being proactive, you can ensure that “Why Credit Card Rewards Might Be Costing You More Than You Think” becomes a cautionary tale you avoid, turning these programs into a genuine financial advantage rather than a hidden cost. [FinansieraTrading.com]