What to include when evaluating a potential investment opportunity can be the difference between a smart financial move and a costly mistake. Are you looking to make an investment that not only grows your wealth but also minimizes risks? Whether you’re a seasoned investor or just starting out, understanding the key elements that determine an investment’s potential is essential. In this guide, we’ll explore the critical factors you need to consider—from analyzing business models and financial performance to assessing market trends and risk management strategies. By the end of this article, you’ll have the knowledge to make confident, well-informed investment decisions that align with your financial goals.

Table of Contents

Key Factors to Consider When Evaluating an Investment Opportunity

Understanding the Business Model

When evaluating a potential investment opportunity, start by understanding the business model. This means analyzing how the company makes money, its core products or services, target market, and competitive advantages. A robust business model should demonstrate clear revenue streams, scalability, and resilience against market fluctuations. Companies with diversified income sources and a solid value proposition are often more sustainable in the long run.

Market Analysis and Industry Trends

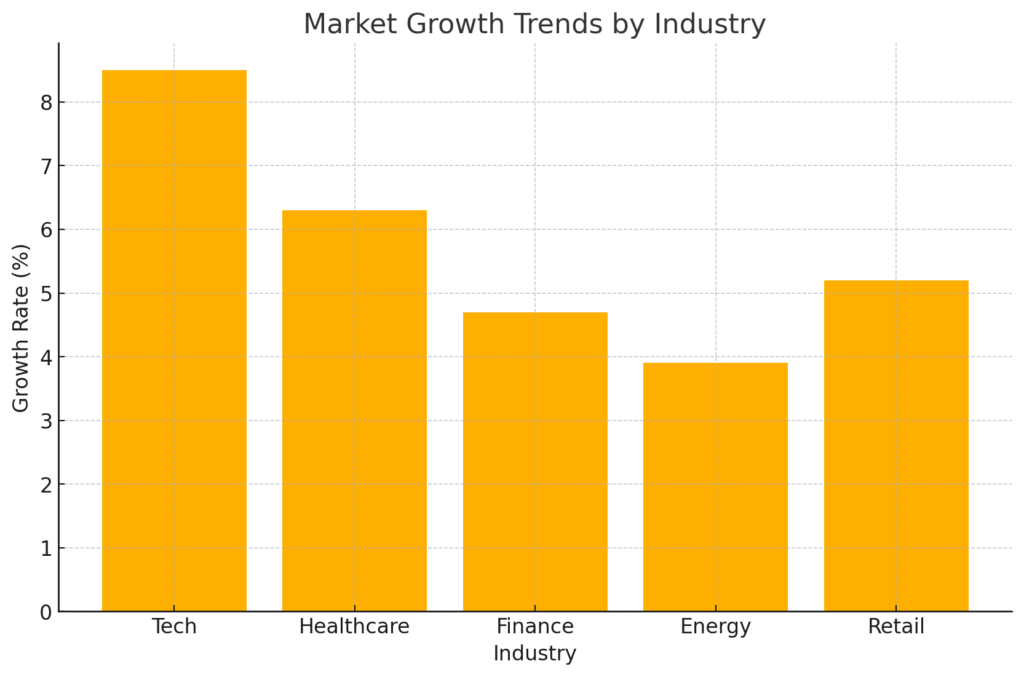

Market analysis helps determine the growth potential of an investment. Evaluate the size of the target market, current demand, and future trends within the industry. Understanding industry dynamics, customer behavior, and competitive landscape provides valuable insights into the company’s positioning and long-term prospects. This analysis helps identify if the market is expanding, stable, or declining, influencing the investment’s potential returns.

Financial Performance and Projections

A company’s financial health is a critical factor. Review income statements, balance sheets, and cash flow reports to assess profitability, revenue growth, and financial stability. Key indicators include profit margins, return on investment (ROI), debt-to-equity ratio, and liquidity. Additionally, scrutinize future financial projections to gauge expected performance and ensure they are based on realistic assumptions supported by historical data.

Risk Assessment and Mitigation Strategies

Every investment carries risks, but identifying and understanding them can help you make smarter decisions. Consider potential risks such as economic downturns, regulatory changes, and operational challenges. Assess how the company manages these risks through diversification, insurance, strategic planning, and robust governance practices. A well-prepared business will have contingency plans and risk mitigation strategies in place.

Management Team and Leadership

The leadership team plays a pivotal role in a company’s success. Evaluate the experience, qualifications, and track record of key executives and board members. Strong leadership is marked by a clear vision, effective decision-making, and the ability to adapt to market changes. Companies led by visionary, ethical, and experienced leaders often outperform their competitors.

Valuation and Pricing

Valuation helps determine if an investment is priced fairly. Use financial ratios like Price-to-Earnings (P/E), Price-to-Book (P/B), and EBITDA multiples to compare the company against industry benchmarks. Consider the intrinsic value based on the company’s assets, earnings potential, and growth prospects. Overpaying for an investment can reduce future returns, while undervalued opportunities may offer significant upside potential.

Legal and Regulatory Compliance

Legal and regulatory compliance is crucial to avoid unexpected liabilities. Verify that the company adheres to relevant laws, industry regulations, and ethical standards. Review any legal disputes, pending litigation, or compliance issues that could affect its operations or financial performance. Strong corporate governance and transparent practices are positive indicators.

Exit Strategy and Liquidity

An effective exit strategy ensures flexibility and the ability to liquidate investments when needed. Consider potential exit options like initial public offerings (IPOs), mergers, acquisitions, or secondary market sales. Liquidity—the ease with which an asset can be converted into cash—is particularly important for investors who may need to access funds quickly without significant losses.

Quantitative and Qualitative Analysis

Combine quantitative data (financial metrics, market statistics) with qualitative factors (brand strength, customer loyalty, management quality) for a comprehensive evaluation. While numbers provide concrete performance indicators, qualitative aspects offer insights into a company’s culture, reputation, and strategic vision. Balancing both perspectives leads to well-rounded investment decisions.

Common Mistakes to Avoid When Evaluating Investment Opportunities

- Overlooking hidden costs or liabilities, which can erode profits

- Relying solely on past performance without considering future prospects

- Ignoring macroeconomic factors like inflation, interest rates, or geopolitical events

- Failing to diversify your portfolio, increasing exposure to specific risks

- Investopedia’s Investment Analysis Guide – A comprehensive resource for understanding investment analysis techniques.

Conclusion

In conclusion, evaluating a potential investment opportunity is a journey that starts with thorough research and a strategic approach. By focusing on key factors such as understanding the business model, analyzing financial performance, and assessing risks, you can make informed decisions that align with your financial goals. Remember, successful investing is not just about numbers; it’s about seeing the bigger picture and being proactive in your strategy.

Now that you’ve learned what to include when evaluating a potential investment opportunity, it’s time to apply these insights. Reflect on your current or future investments, identify areas for improvement, and make data-driven decisions. Have thoughts or experiences to share? Leave a comment below, share this article with fellow investors, or explore more resources on investment strategies.

For further reading, check out The Balance’s Guide to Smart Investing, which offers additional tips and insights to enhance your investment knowledge. [FinansieraTrading.com]