How to build a financial safety net in just 6 months? This is a question many people ask when faced with financial uncertainty. Life is unpredictable, and unexpected expenses like medical emergencies, job loss, or sudden repairs can throw your finances off balance. Without a proper plan in place, financial stress can become overwhelming.

The good news is that by taking the right steps, you can create a strong financial foundation in a short period. This guide will walk you through essential strategies to assess your current financial standing, reduce debt, increase savings, and create multiple streams of income. Whether you’re starting from scratch or looking to strengthen your finances, these steps will help you secure your future and gain financial independence.

Table of Contents

Why a Financial Safety Net Is Essential

A financial safety net acts as your personal economic shield against unforeseen expenses. Without one, you may have to rely on loans, credit cards, or even borrow from friends and family to get by. Below is a quick comparison of how having a financial safety net impacts your financial security.

| With a Safety Net | Without a Safety Net |

|---|---|

| Peace of mind and security | High financial stress and anxiety |

| Ability to cover unexpected expenses | Relying on high-interest loans or credit cards |

| Financial independence | Increased debt accumulation |

| More opportunities to invest and grow wealth | Living paycheck to paycheck |

Key Data:

- 78% of Americans live paycheck to paycheck (Source: Forbes).

- 60% of households cannot cover a $1,000 emergency (Source: Bankrate).

Step 1: Assess Your Current Financial Situation

Before you start building a financial safety net, you need to understand your financial standing.

Steps to Assess Your Finances:

- Track Your Monthly Income & Expenses – Use a budgeting app or spreadsheet to identify where your money goes.

- Identify Unnecessary Spending – Cancel unused subscriptions, cut back on dining out, and find ways to reduce non-essential expenses.

- Determine Your Emergency Fund Goal – Ideally, aim to save at least 3-6 months’ worth of living expenses.

Helpful Resource:

Use Mint or YNAB to automate your budgeting and track spending.

Step 2: Create a Realistic Savings Plan

Consistent savings habits are key to achieving financial security within six months.

Best Savings Strategies:

- Pay Yourself First – Set up automatic transfers to a high-yield savings account before spending.

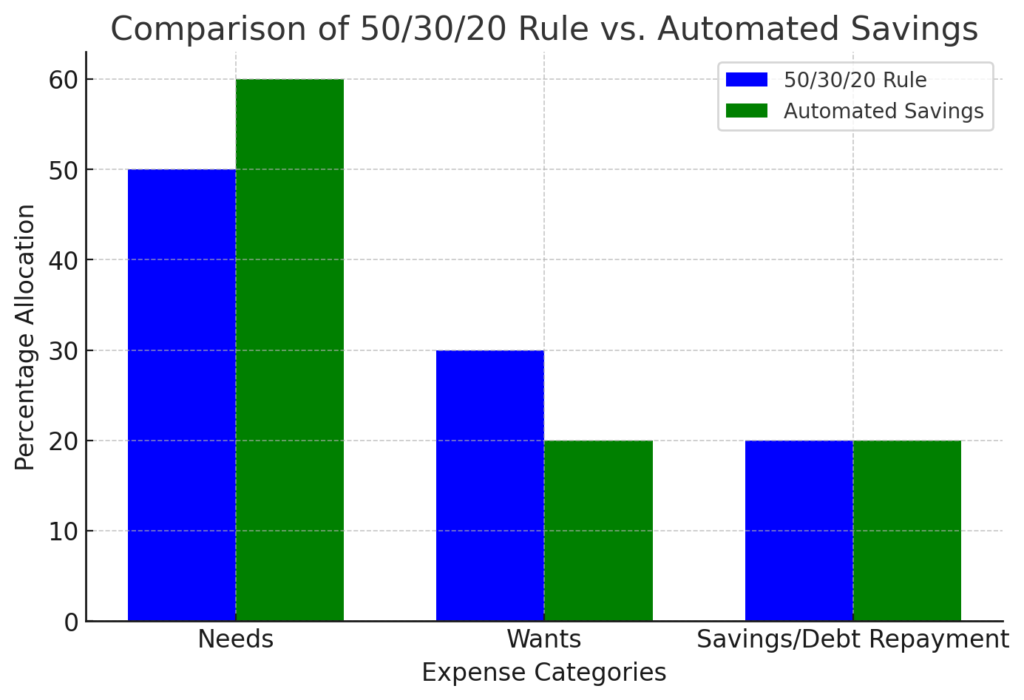

- Use the 50/30/20 Rule – Allocate 50% for needs, 30% for wants, and 20% for savings/debt repayment.

- Consider Side Hustle Income – Direct any extra earnings into your emergency fund.

Step 3: Increase Your Income Streams

Diversifying your income ensures you can save faster while also securing financial stability.

Income Boosting Ideas:

- Freelancing (Upwork, Fiverr)

- Selling Unused Items (eBay, Facebook Marketplace)

- Monetizing Skills (Tutoring, Course Creation, Consulting)

- Ridesharing & Delivery Jobs (Uber, DoorDash)

Mind Map Suggestion: A breakdown of passive vs. active income streams.

Step 4: Reduce Debt and Manage Liabilities

High-interest debt can slow your financial progress, so tackling it early is crucial.

Debt Reduction Techniques:

- Snowball Method: Pay off smallest debts first to gain momentum.

- Avalanche Method: Focus on high-interest debts to save more in the long run.

- Negotiate Bills: Call service providers to lower rates (e.g., insurance, phone bills).

Step 5: Build an Emergency Fund

Having liquid savings ensures that unexpected expenses don’t derail your financial goals.

How to Build an Emergency Fund Quickly:

- Start Small: Even $500 can make a difference.

- Redirect Bonuses & Tax Refunds to your savings account.

- Open a Separate High-Yield Savings Account to prevent impulse spending.

A comparison of traditional savings accounts vs. high-yield accounts.

| Criteria | Traditional Savings | High-Yield Savings |

|---|---|---|

| Interest Rate | Low (0.01-0.1%) | High (2-4%) |

| Minimum Balance | Higher to Avoid Fees | Lower or None |

| Accessibility | Immediate Withdrawals | Immediate Withdrawals |

| Risk Level | Very Low | Very Low |

| Growth Potential | Slow Growth | Faster Growth |

| Fees & Charges | Possible Monthly Fees | Usually No Fees |

Step 6: Invest Wisely for Long-Term Growth

Once your emergency fund is established, focus on growing your wealth through low-risk investments.

Smart Investment Options:

- Index Funds & ETFs – Low-cost, diversified investment choices.

- Certificates of Deposit (CDs) – Safe options with fixed returns.

- Retirement Accounts (401k, IRA) – Benefit from employer contributions and tax advantages.

| Investment Type | Risk Level | Expected Returns (Annual) |

|---|---|---|

| Savings Account | Very Low | 0.01% – 1% |

| Certificates of Deposit (CDs) | Low | 1% – 3% |

| Bonds | Low to Moderate | 2% – 5% |

| Index Funds | Moderate | 6% – 10% |

| Stocks | High | 7% – 15% |

| Real Estate | Moderate to High | 8% – 12% |

| Cryptocurrency | Very High | Highly Volatile (10% – 100% or more) |

Step 7: Maintain and Strengthen Your Safety Net

A financial safety net is not a one-time effort—it requires ongoing maintenance.

Ongoing Financial Strategies:

- Review Your Budget Monthly – Adjust as needed.

- Set New Financial Goals – Aim for a 12-month fund after reaching 6 months.

- Continue to Invest – Explore additional investment opportunities.

Conclusion

Building a financial safety net in just 6 months is achievable with disciplined savings, smart investments, and income diversification. Taking control of your finances today ensures a more secure and stress-free future. Start applying these strategies now, and watch your financial confidence grow.

Join the Conversation!

What are your best tips for saving and building financial security? Drop your comments below and share your experiences! Don’t forget to explore more financial guides and subscribe for expert insights. [FinansieraTrading.com]

Recommended Resource:

Visit the Consumer Financial Protection Bureau for financial planning tips.