Best investment apps for millennials in 2025 are reshaping the way young investors manage and grow their wealth. As technology continues to evolve, these apps provide a seamless, accessible, and innovative approach to investing, catering to the needs of a tech-savvy generation. With options ranging from automated portfolios to commission-free trading and socially responsible investment choices, millennials now have the tools to build a secure financial future directly from their smartphones.

Millennials are known for prioritizing convenience, customization, and affordability, and investment apps have stepped up to deliver precisely that. Whether you’re just starting your investing journey with a few dollars or looking for advanced features like tax optimization and financial planning, these apps are designed to help you reach your financial goals. In this blog post, we’ll dive into the best investment apps for millennials in 2025, highlighting their features, benefits, and why they’re the perfect tools to unlock financial independence.

Table of Contents

Why Millennials Are Embracing Investment Apps

Millennials prioritize convenience and accessibility in their financial journeys. Investment apps offer features such as automated investing, fractional shares, and seamless user interfaces. These tools empower millennials to grow their wealth without the complexities of traditional investing methods.

Top Features to Look for in Investment Apps in 2025

When choosing the right investment app, millennials should consider these key features:

- User-friendly interface: Apps that are intuitive and easy to navigate.

- Low fees: Affordable services with no hidden charges.

- Automated portfolios: Robo-advisors for hands-free investing.

- Sustainability options: ESG-focused portfolios for socially conscious investors.

- Educational resources: Built-in guides and tutorials to improve financial literacy.

The Best Investment Apps for Millennials in 2025

1. Acorns: Invest Spare Change

Acorns is an excellent app for beginners, allowing users to invest spare change automatically. Its robo-advisor technology ensures hands-free management of diversified portfolios. Features like retirement accounts and sustainable investment options make it ideal for millennials.

Key Features:

- Automatic round-ups from purchases.

- User-friendly design.

- Integration with retirement accounts (IRA/401k).

2. Robinhood: Commission-Free Trading

Robinhood revolutionized investing with its zero-commission trading model. The app is popular among millennials for its no-fee trades and real-time market data.

Key Features:

- No commission fees for stocks and ETFs.

- Access to cryptocurrency trading.

- Fractional share investing.

| Feature | Robinhood | Traditional Brokers |

|---|---|---|

| Trading Fees | $0 per trade | $4.95 – $9.99 per trade |

| Account Minimum | $0 | $500 – $2,500 |

| Cryptocurrency Trading | Available | Limited or Not Available |

| Fractional Shares | Available | Rarely Available |

| Ease of Use | User-friendly app interface | Complex interfaces in many cases |

| Access to Real-Time Data | Free | Often behind premium subscriptions |

| Investment Options | Stocks, ETFs, Crypto, Options | Stocks, ETFs, Bonds, Mutual Funds |

| Additional Fees | None | Inactivity and transfer fees apply |

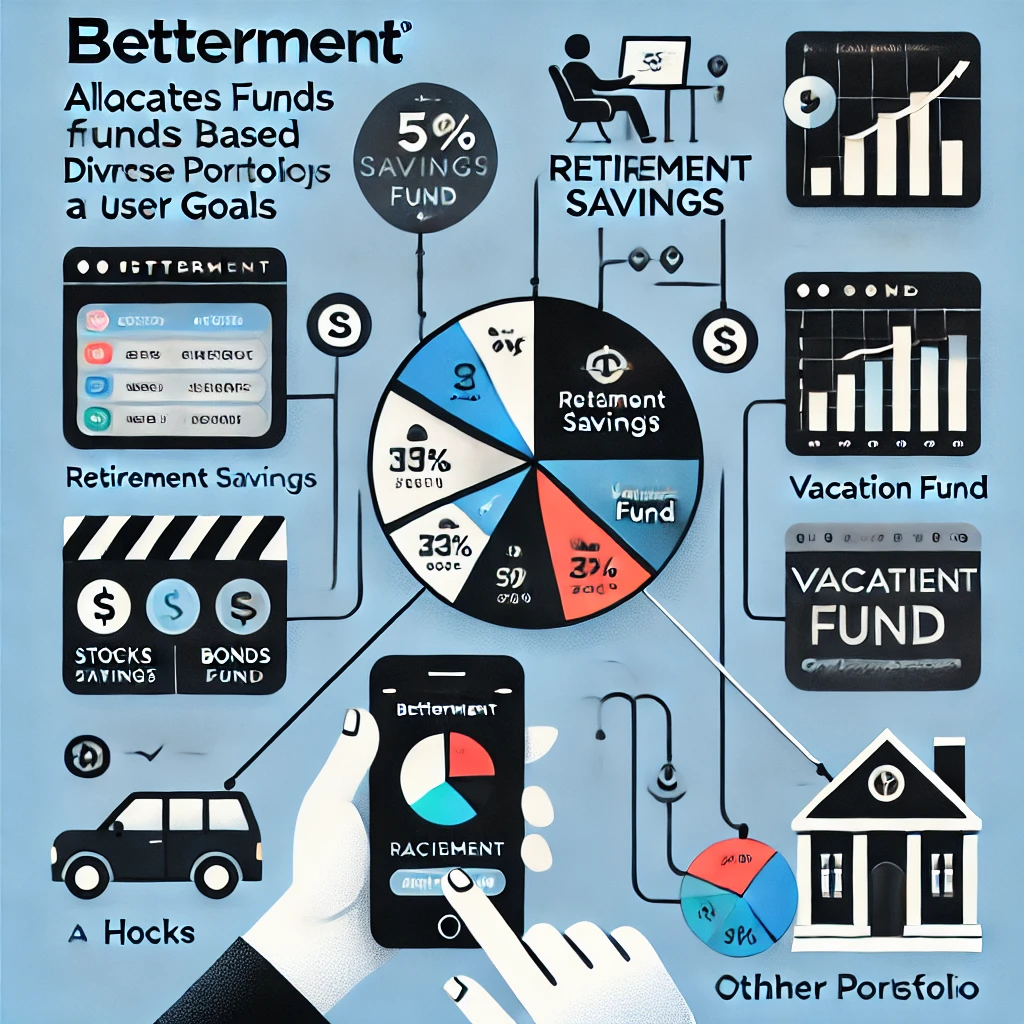

3. Betterment: Smart Robo-Advising

Betterment specializes in automated, goal-based investing. It’s perfect for millennials looking for long-term wealth growth without the hassle of manual management.

Key Features:

- Personalized financial goals and strategies.

- ESG (Environmental, Social, Governance) investment portfolios.

- Automatic portfolio rebalancing.

4. Stash: Invest and Learn

Stash combines investment tools with education, helping millennials make informed decisions. It offers access to fractional shares and guides users through building a diversified portfolio.

| Feature | Acorns | Robinhood | Betterment | Stash | Wealthfront |

|---|---|---|---|---|---|

| Trading Fees | $1-$5/month | $0 per trade | 0.25% annual fee | $3-$9/month | 0.25% annual fee |

| Account Minimum | $0 | $0 | $10 | $0 | $500 |

| Fractional Shares | Available | Available | Not Available | Available | Not Available |

| Cryptocurrency Trading | Not Available | Available | Not Available | Not Available | Not Available |

| Ease of Use | Very User-Friendly | User-Friendly | Very User-Friendly | Moderately User-Friendly | Very User-Friendly |

Key Features:

- Built-in educational tools.

- Customizable investment options.

- Access to fractional shares.

Column/Table Suggestion:

| Feature | Stash | Acorns | Robinhood |

|---|---|---|---|

| Fractional Shares | Yes | Yes | Yes |

| Education Tools | Yes | No | No |

| Crypto Trading | No | No | Yes |

5. Wealthfront: Comprehensive Financial Planning

Wealthfront goes beyond investing by offering cash management, tax optimization, and personalized financial advice.

Key Features:

- Tax-loss harvesting.

- Comprehensive planning tools.

- Low management fees (0.25%).

Why Millennials Should Start Investing Now

The earlier millennials begin investing, the more time their money has to grow through compounding. With easy-to-use apps, anyone can start with as little as $5 and build a financially secure future.

Conclusion

In 2025, millennials are leveraging technology to take control of their financial futures, and the best investment apps for millennials in 2025 are tailored to meet their unique needs. With features like automated investing, commission-free trading, and educational resources, these apps make it easier than ever to start building wealth.

| Feature | Acorns | Robinhood | Betterment | Stash | Wealthfront |

|---|---|---|---|---|---|

| Two-Factor Authentication (2FA) | Yes | Yes | Yes | Yes | Yes |

| Encryption | 256-bit encryption | 256-bit encryption | 256-bit encryption | 256-bit encryption | 256-bit encryption |

| Fraud Protection | Yes, bank-level security | Yes, SIPC protection | Yes, SIPC protection | Yes, SIPC protection | Yes, SIPC protection |

| Insurance Coverage | Up to $500,000 (SIPC) | Up to $500,000 (SIPC) | Up to $500,000 (SIPC) | Up to $500,000 (SIPC) | Up to $500,000 (SIPC) |

| Biometric Login | Available | Available | Available | Available | Available |

Studies show that over 70% of millennials prefer mobile-based investing platforms due to their convenience and flexibility. Apps like Acorns and Stash allow users to start investing with as little as $5, making them accessible to everyone. Meanwhile, platforms like Betterment and Wealthfront offer advanced tools such as tax-loss harvesting and personalized financial planning, which can boost returns and optimize savings.

The earlier millennials adopt these tools, the more they benefit from the power of compounding. For example, investing $100 monthly starting at age 25 can grow to over $150,000 by age 55 (assuming a 7% annual return), whereas starting at 35 would yield only about $72,000.

Choosing the right app from the best investment apps for millennials in 2025 is the first step toward financial independence. Whether your goal is to save for retirement, buy a home, or simply grow your wealth, these apps offer everything you need to achieve your dreams. Start investing today and secure your financial future!